With only a month left before Spring hits it’s a good time to look back on the year so far and what’s to come in the Sydney property market. Since May we have seen the market level out to being more of an even or calm marketplace.

In large part there is an element of caution amongst buyers which means they are less willing to compromise, than they have been in previous years.

Vendors have needed to be more realistic than in years past to sell their property. I put this down to a few factors: buyer sentiment changing, the majority of people buying or selling for lifestyle reasons, and interest rates. Of course, there are outlier properties where this isn’t the case and they sell strongly. Overall current market conditions present a great opportunity to buy.

In our core area of 15km around the CBD we are seeing that the market is split up into 2x tiers.

There’s premium A grade properties, that are priced fairly which have very strong demand and are selling either at auction or for an offer above the guide prior to auction. There is limited supply in this tier of property.

Investor-grade stock or properties that need renovating make up the majority of the supply in the market. These properties can also be priced too high on occasion. The reason for these types of homes making up the majority of the market are timeframes of development plans, interest rates, building costs or the property having some downsides.

4x Recent Purchases – 3x Off-Market, 1x Pre-Auction

Seaforth

Lewisham

Cammeray

Killara

On average there are only 2 genuine buyers per property

There is a growing trend now where numbers at open homes are strong, yet when it comes to negotiating on that property only 1 – 2 buyers show real interest. It’s evident across markets in Sydney, there are some exceptions to this but it just shows how the market is levelling out.

I experienced this first hand for a past client who sold in Leichhardt, there were a number of contracts out in the first week and multiple interested parties. Yet in the end there was only 1 genuine buyer, which they ended up selling to. The benefit for buyers in this environment is less FOMO, more time for decision making and power in negotiations with vendors.

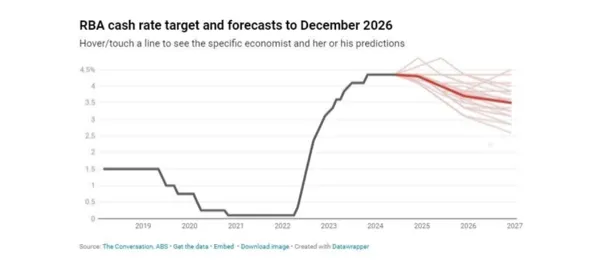

Most economists are forecasting rate cuts by early to mid-2025. There was a recent survey of 29 economists and 24 expect the cash rate to be lower by mid-next year.

By 2026, they forecast the cash rate will be at 3.50% by the end of 2026. This is 0.85% change from today, this would result in circa 8.5% increase in borrowing capacity. Further fuelling property price increases for the years to come.

For the remainder of 2024, I foresee levelling out in prices and stable market conditions being prevalent, if cash rate cuts come in Q4 this year this could lead to a strong finish to the year.

If you want to have a chat about the current market or your property plans get in contact with us today.